New FarmDoc Tool Assesses Performance of Crop Insurance

by Gary Schnitkey

original source FarmDocDaily

A new “Product Performance” section has been added to the 2017 Crop Insurance Decision Tool. By using this section, users can examine per acre premiums and payments from alternative crop insurance products from 1995 to 2015, thereby allowing users to gain a feel for the historical performance of crop insurance products. For corn, users will notice that the 2012 drought had large impacts on crop insurance performance.

User Selections

From the 2017 Crop Insurance Decision Tool, users will select “product performance” from the menu and make the following selections (see Figure 1):

- State. Any state in the nation can be selected.

- County. Any county can be selected.

- Crop. Information is available for corn, soybeans, and wheat.

- Product. Data are available for Revenue Protection (RP), Yield Protection (YP), RP with the harvest price exclusion (RPwHPE), Area Revenue Protection (ARP), Area Yield Protection (AYP), and ARP with harvest price exclusion (ARPwHPE).

- Coverage level. Choices are each available coverage level (50 to 85% for RP) and an “all” selection.

Figure 1 shows a Logan County, Illinois example where corn is selected. RP performance will be given for all coverage levels, meaning that data over the 50% to 85% coverage levels are averaged and reported.

Product Performance Output

Figure 2 shows output from selections in Figure 1. All data comes from Summary of Business, which is maintained by the Risk Management Agency (RMA). The 2017 Crop Insurance Decision Tool provides results from 1995 to 2015. Yearly performance rows will be blank if no use of the chosen product occurred during the year.

RP along with YP and RPwHPE came into existence in 2011. As a result, RP performance is reported from 2011 onward. Before 2011, Crop Revenue Coverage (CRC) and Revenue Assurance (RA) plans where in use. RP, CRC, and RA all are revenue insurances that allow guarantees to increase if harvest price is higher than projected price (RA had an option that excluded the guarantee increase, but this option was used rarely). Therefore, CRC and RA performance are reported for years prior to 2011.

The “product performance” section first reports acres insured using the selected combination. RP type products were first introduced in 1997 and 7,916 acres were insured in Logan County (see Figure 2). Use grew to 125,359 acres in 2014, decreasing slightly to 121,619 acres in 2015. RP is now the most used crop insurance product, having over 90% use in many counties (see farmdoc daily, January 4, 2017).

Next, the section reports premiums in three columns: total, subsidy, and farmer-paid premium. The subsidy represents the premium paid by the Federal government as specified by subsidy schedules written into statute. As its name implies, “farmer-paid premium” is paid by the farmer. Farmer-paid premium plus subsidy equals total premium. In Logan County, total premium was $40.56 per acre in 2015 (see Figure 2). Of the total premium, $19.79 per acre was subsidy and $20.77 per acre was farmer-paid premium.

Also given are per acre insurance payments. These are payments to farmers resulting from claims to crop insurance products. In 2015, insurance payments on RP products averaged $32.95 per acre.

The final two columns provide an evaluation of the crop insurance products. Insurance payments minus farmer-paid premium show insurance payments received from the products relative to farmer-paid premium. Positive values mean that insurance payments were larger than farmer-paid premium.

In high payment years, payments minus farmer-paid premium will be positive. For example, insurance payments were high in the 2012 drought year, resulting in payments minus farmer-paid premium of $302.26. In low loss years, payments minus farmer-paid premium will be negative. From 1997 to 2015, negative values occurred 13 out of 19 years. From 1995 to 2015, farmers received an average of $10.38 more in premium than in payments (see Figure 2). From 2006 to 2015, farmers received $22.55 per acre more in payments than they paid in premium (see Figure 2).

The loss ratio equals insurance payments divided by total premiums. In 2015, the loss ratio was .81. Loss ratios less than 1.0 mean that insurance payments were less than total premium. Conversely, loss ratios higher than 1.0 indicate that payments were greater than premium. Over time, RMA’s goal is to maintain a loss ratio near but below 1.0.

Interpretation

Past performance will not be entirely reflective of how the products will perform in the future. RMA makes adjustments to premiums over time. For example, continuing high payments on products will result in increasing premiums and vice versa. Moreover, RMA continually conducts studies of its rating procedures, which can cause premium changes. As a result, current premiums will vary from historical premiums even given identical conditions. As a result, future performance will not match historical performance.

Moreover, values are averages across many farms in a county. In 2015, average RP premium in Logan County were $20.77 per acre. Some farmers paid higher premiums depending on crop insurance choices and historical yields, and vice versa. The average RP payment in 2015 was $32.95 per acre. Again, payments vary across farms in the county. Some farmers did not receive payments in 2015 while other farms received payments much larger than $32.95 per acre.

Importance of 2012 in Illinois

The drought year of 2012 has a large impact on crop insurance performance. In 2012, the loss ratio for RP in Logan County was 5.84, much higher than the .89 average from 2006–2015 (see Figure 2). If 2012, had not occurred, the .89 average loss ratio for the 2006–2015 would have decreased to .46.

Payments minus farmer-paid premium averaged $22.55 per acre from 2006 to 2015. Without 2012 included, payments minus premium averaged -$8.53 per acre.

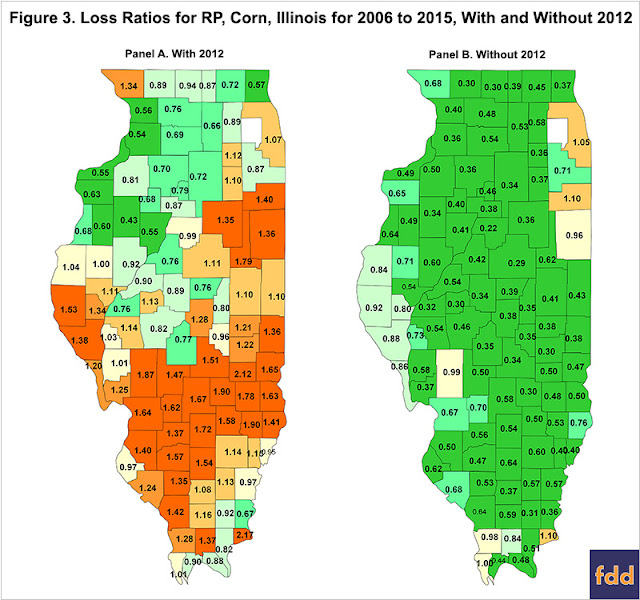

The drought has similar impacts on many Illinois counties. To illustrate, Panel A of Figure 3 shows average RP loss ratios for corn in each Illinois county for 2006 to 2015. The 2012 drought particularly impacted farms in southern and eastern Illinois, causing many counties to have loss ratios above 1.0. Panel B shows loss ratios for 2006–2015 with 2012 excluded. Without 2012, most counties had loss ratios well below 1.0.

These comparisons point out the importance of “extreme” years on overall crop insurance performance. Severe droughts like 2012 occur in the Midwest occasionally, with much debate concerning their frequency of droughts. The last drought of comparable magnitude to 2012 happened in 1988, 25 years previous to 2012, suggesting infrequent droughts. However, two additional, large yield shortfalls occurred in the 1980s: 1980 and 1983. Three severe events in a decade give a very different perspective on the frequency of droughts than the more recent history of the passing of 25 years. Which represents the future the best is an open question, with a blend of the 1980s experience and the recent more moderate losses likely to be the most appropriate answer.

Summary

The Product Performance section allows users to examine historical performance of crop insurance plans, thereby providing intuitions on the frequency of payments, the size of payments, and the net costs of the plans. While evaluating past performance is useful, future performance will not necessarily match historical performance as RMA is adjusting premiums over time. Moreover, the frequency of large-scale droughts has a large impact on insurance performance. Whether there are 0, 1, or 2 drought years in the next ten will dramatically influence crop insurance performance.