Here’s Where Your Illinois Tax Dollars Go

Courtesy: Illinois Comptroller Courtesy, Illinois Comptroller

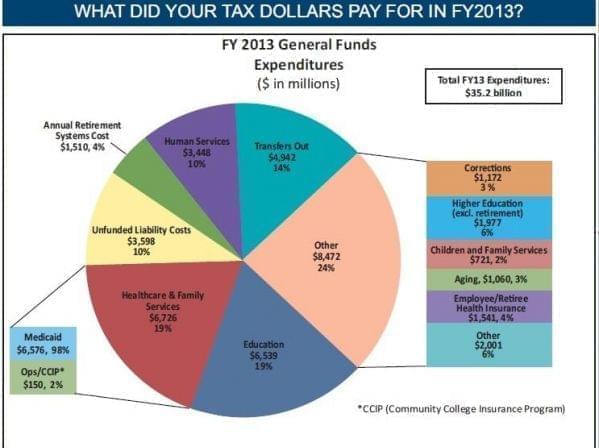

It's tax day and that got us wondering about where all your state tax dollars go every year. One answer comes in the form of the pie chart above, courtesy of the Illinois Comptroller's office.

It shows 2013 spending from the state general fund.

For the first time, the comptroller is sending out the breakdown of state spending with every refund check it mails. The majority of Illinois tax refunds are deposited electronically, though, so the information is also available online at the comptroller's website.

Aside from the catch-all "other" category in the chart above, healthcare and family services, and education remained the largest chunks of state spending in 2013.

Illinois State Senate President John Cullerton also put his own "receipt" of state funding last October. It's available on his website, and breaks spending down by dollars and cents, rather than percentages:

- 23¢ of every dollar pays for health care – that’s mostly Medicaid services for low-income children, seniors and people with disabilities.

- 19¢ of every dollar pays goes to preschool-to-12th grade education. That’s mostly the state’s share of our local public elementary schools and high schools’ funding.

- 17¢ of every dollar goes to pay for public employee pensions. The General Assembly is currently working on a plan to bring this number down so that more funding can go to important priorities like education.

- 15¢ of every dollar pays for human services. Human services include DCFS programs for abused and neglected children, drug abuse treatment and prevention and more.

- 6¢ of every dollar goes to debt payments.

- 6¢ of every dollar pays for higher education – public universities and financial aid like MAP grants.

- 5¢ of every dollar pays for public safety – the State Police, prisons and consumer safety programs.

- 9¢ of every dollar goes to pay for everything else. A lot of that money (about 4¢) goes to local governments. The rest goes to important programs like public transportation, state parks, DMVs and more.

- It’s worth noting that only 11¢ of every dollar (spread out across all these categories) is used to pay for the state workforce.