Small Rate Hike, Web Conveniences With 2016 ACA Enrollment

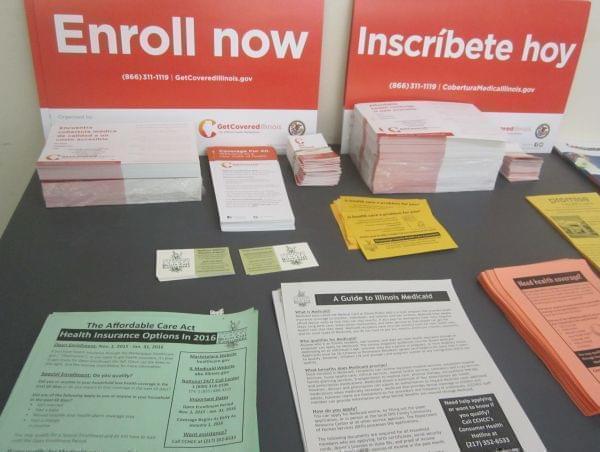

Literature on enrollment in the nation's health care law at Champaign County Health Care Consumers' office in downtown Champaign. Jeff Bossert/Illinois Public Media

Illinoisans who get their health insurance through the nation’s health care law are expected to see a slight increase in their premium during the upcoming sign-up period. But a local advocacy group says the process should be more user-friendly.

Otherwise, Community Organizer Jen Tayabji with Champaign County Health Care Consumers said the three-month enrollment period that starts this Sunday will not be much different from the previous two.

Tayabji reminds all current enrollees to review their financial information to make sure nothing has changed, and see if there’s an option for a better plan.

The federal government says most rates for plans are going up about six percent in Illinois. Tayabji says the exact size of the increase depends on whether you live in the Chicago area, or downstate.

“In our area, unfortunately we do see higher premiums because we have less insurance companies, and so less competition," he said. "So that allows prices to go up. In Chicago, often times they will have lower prices and lower premiums because there are more provider options and more insurance options.”

Tayabji says the Health Care.gov website now asks for a zip code, the enrollee’s age, how often they visit a doctor, whether someone is shopping for his or herself or someone else, and their income - to see if they’re eligible for a tax credit.

She adds many who feel they can’t afford a health insurance plan might qualify for Medicaid.

Tayabji says anyone who currently has a plan through the health insurance marketplace should expect to receive two different letters before open enrollment starts November 1st. One comes from the marketplace to explain what their tax credit would be in 2016, or if someone needs to submit new documents to update that credit.

The other letter comes from the health insurance company, letting a consumer know if a premium or benefit is changing, or if a plan is no longer being offered.

Links

- Open Enrollment Period For Health Care Ends Sunday

- Health Care Enrollment Exceeds 6 Million

- How The Health Care Law Could Spur New Businesses

- Health Care Enrollments Up, But Still Well Short Of Goal

- Health Care in All the Wrong Places

- How Medigap Coverage Turns Medicare Into A Health Care Buffet

- Rep. Shimkus Grills Contractors About Health Care Website

- Obama: Health Care Site Is Troubled; Affordable Care Act Is Not

- Enrollments For The Health Care Exchanges Trickle In, Slowly

- Jobs Available Under Health Care Law In Illinois

- Health Care Law Means Champaign County To Have Largest Medicaid Growth

- US Supreme Court Hears Arguments on Health Care Law

- Survey: Health Care Tax Credits Will Reach More Than 1 Million Illinoisans in 2014