Understanding the Tax Return Cases

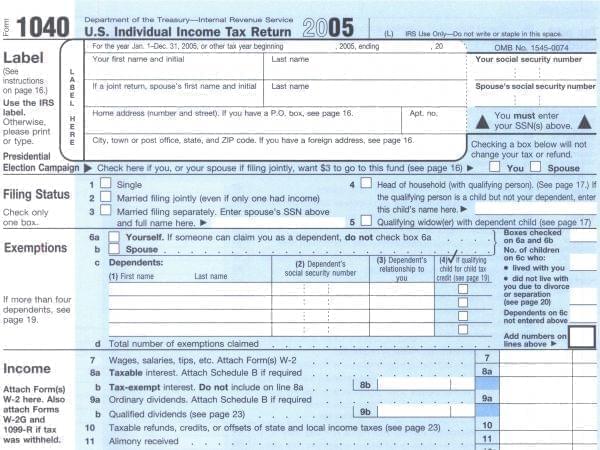

1040 Tax form, 2005 Wikimedia Commons

In two separate cases, President Trump’s lawyers have asked the Supreme Court to block different subpoenas that would reach the president’s tax returns. The cases do not directly relate to the impeachment proceedings, but information from the tax returns could be used in them.

The first case comes out of New York, where the Manhattan district attorney is investigating several individuals and organizations for crimes they may have committed. Because grand jury proceedings are secret, we do not know more about who those individuals and organizations are and what the possible crimes might be.

What we do know is that, as part of the investigation, a New York state grand jury subpoenaed the accounting firm for the Trump Organization. The subpoena directed the accounting firm to turn over documents, including the president’s personal income tax returns. Because the state-court subpoena sought records about him, the president filed a lawsuit in federal court seeking to block the subpoena.

Bob Lawless from the University of Illinois College of Law

The second case arises out of Washington, DC, where a congressional committee subpoenaed the same accounting firm to get the president’s personal income tax returns. The congressional committee is investigating whether the president’s required financial disclosures complied with the law. Like the New York case, the president filed a lawsuit seeking to block the congressional subpoena.

The two cases are alike in three ways. First, neither involve executive privilege. Executive privilege protects deliberations between the president and his closest advisors. The tax returns involve the president’s personal financial affairs, not affairs of state.

Second, in both cases the subpoena is not directed to the president himself but to a third party. That makes it more difficult for the president to argue that complying with the subpoena will distract him from performing his duties, although the president has other grounds to oppose them.

The two cases are also alike in that the president lost both in the lower courts. But, despite their superficial similarities, it would be a mistake to lump them together. The two cases present very different issues. The procedural details matter, a lot.

The New York case involves a state criminal investigation and with it the relationship between the state and federal governments. On one hand, the Constitution surely does not grant the president absolute immunity from state-law crimes. On the other hand, it would turn state and federal relations upside down in our large republic to hand the power to investigate the president to every state’s attorney in every one of our 3,000 counties. Just as the president’s supporters complain about his treatment by the district attorney in deep-blue New York, the tables could turn very quickly for a Democratic president and a state’s attorney in a deep-red rural county. Like the lower court, the Supreme Court probably will look for narrower grounds on which to decide the case, such as the fact that the subpoena is not directed at the president himself.

In the other case, it is not the balance of power between state and federal governments that is at stake. Rather, the question is the separation of powers between all three branches of the federal government. The president’s claim is first that the legislative branch’s subpoena for his tax returns has gone beyond its legitimate power. But, that claim also would require the judicial branch to look behind the legislature’s stated reasons rather than accepting them at face value.

So far, the Supreme Court has preserved the status quo while it decides whether it will accept the president’s appeals. We should know by mid-December. Most observers expect that the Court will hear the cases, meaning we could expect a historic opinion on presidential powers late next spring when the presidential campaigns are in full swing.