2018 Forecast: US Farm Income To Sink To 12-Year Low

Courtesy of US Dept. of Agr

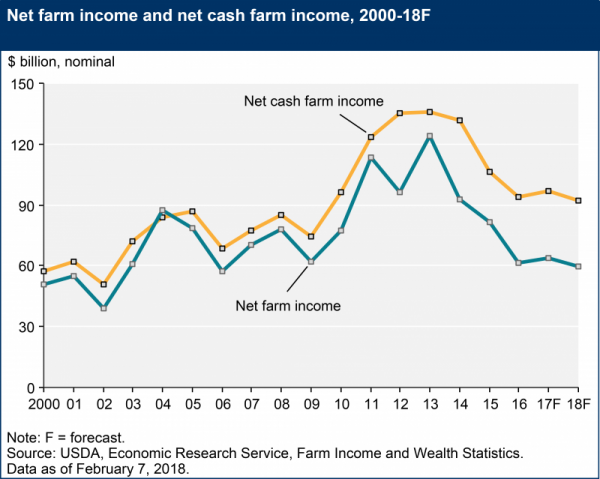

Farm income will likely drop nearly 7 percent from last year to $59.5 billion, according to a U.S. Department of Agriculture report released Wednesday. The drop is due to continued low prices for crops like corn and soybeans, as well as higher fuel and labor costs.

“It’s not a rosy picture,” University of Missouri market analyst Scott Gerlt says. “Anyone who has been around agridculture knows that the past few years haven’t been as good.”

Aready, it’s tough for producers to turn a profit on grain, due to good weather and large harvests in recent years, Gerlt says.

YAfter peaking at upward of $120 billion in 2013, farm income for the past three years seems to be hovering at about $60 billion.

“Quite frankly, when you really dig into the numbers and you look at median farm household income — not all farm income but income from farming — it's been negative since 2013,” says John Newton, director of market intelligence at the American Farm Bureau Federation. “That means more than 50 percent of farmers are losing money.”

Beyond crops, dairy farmers will likely deal with a fourth year of lower milk prices.

But the USDA has good news for cattle ranchers, who can expect a slight increase in business and cheaper animal feed. Consumers, meanwhile, will keep seeing cheap prices at the grocery store on beef, pork and vegetables.

Any drought or flood will change the forecasted numbers, Newton notes, but one way farmers can dig out of the hole is if the U.S. looks at adding more international markets and strengthening current trade deals, like NAFTA. (Ag groups and lawmakers are worried about NAFTA, as President Trump has indicated he wants to renegotiate the deal with Canada and Mexico , and has indicated he may consider pulling out of it.)

“When we saw record farm income in 2014, it had a lot to do with trade as well as new sources of domestic demand (for ethanol),” Newton says. “So going forward trade definitely is the X-factor for farm income increase.”

The USDA’s forecast also says farm debt will go up by $3.8 billion to $389 billion, nudged up primarily by real estate debt. Direct government farm payments are set to decline $2.1 billion due to drops in payments from two farm safety-net programs (outside of crop insurance). Agricultural Risk Coverage and Price Loss Coverage are calculated on averages based on prices and revenue, which have been low.

“Certainly with this tight income environment, folks are going to need to (have tough conversations) with their bankers to see how they can get lines of credit or operating loans and find ways that personally on the farm they can find some more efficiencies,” Newton says.

Follow Kris on Twitter: @krishusted