House Speaker Suggests Restoring Five-Percent Income Tax

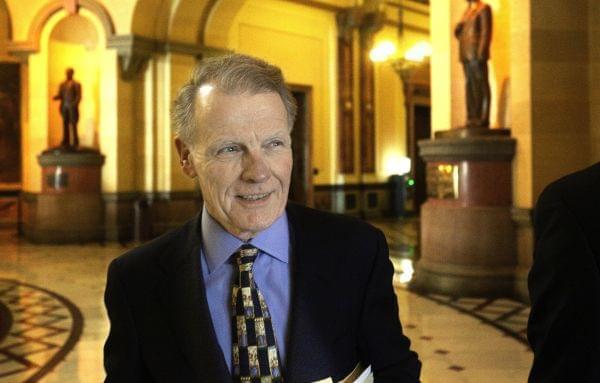

Illinois Speaker of the House Michael Madigan, D-Chicago, speaks to reporters before walking into the governor's office at the Illinois State Capitol Tuesday, Dec. 1, 2015, in Springfield. Seth Perlman/Associated Press

House Speaker Michael Madigan suggested Wednesday that the state's income tax should be restored to the 5 percent level it was at until January. The Chicago Democrat told a City Club of Chicago crowd that the state's multibillion-dollar deficit demands a tax hike.

A four-year, temporary increase from three percent to five percent expired last winter with the blessing of incoming Republican Gov. Bruce Rauner. It dropped to 3.75 percent.

"A good place to begin would be the level we were at before the income tax expired," Madigan said. "And starting there you can go in whatever direction you want to go."

Democrats are locked in a standoff with Rauner over a state budget which should have taken effect July 1. They want a tax increase and spending cuts to address a multibillion-dollar deficit.

Illinois raised the income tax rate in 2011, but only temporarily. It partially rolled back at the start of 2015, falling from five percent to 3.75 percent for individuals. That's contributed a deficit in the state budget

Rauner wants far-reaching changes to improve the business climate which Madigan calls "extreme.''

Meanwhile, the Republican leader of the Illinois Senate is critical of Madigan's comments. Senate Minority Leader Christine Radogno of Lemont called the idea "outrageous'' Wednesday.

She says Gov. Bruce Rauner should be able to make basic changes to make Illinois businesses more competitive first.

UPDATE 8 p.m: Madigan’s office clarified his comments, issuing a statement Wednesday night saying that he has no plans to introduce legislation to raise the income tax rate. He says headlines to the contrary are misleading.

Links

- Budget Stalemate Hurting Recruitment At Lincoln’s Challenge

- East Central Illinois Community Colleges Grapple with State Budget Impasse

- U of I Trustees Call On State Leaders To End Budget Impasse

- Gov. Rauner, Democratic Leaders Negotiating November Meeting On Budget

- Past Due: Budget Deal Could Bring Tax Increase

- Bruce Rauner Unveils Plans To Lower Income Tax

- Illinois’ Unconventional Budget-Making Methods (And The One That Seemingly Worked)

- Provost: U of I Urbana Campus Coping With State Budget Impasse

- Pressure Mounts For Lawmakers To End Budget Impasse

- Higher Education Officials: Lack Of State Budget Is Crippling Operations

- Rauner: Budget Standoff ‘Could Go On For A While’

- Quinn: Budget Impasse “Disappointing” But Won’t Run For Office