National Study Spotlights Illinois Pension Problems

TEACHERPENSIONS.ORG

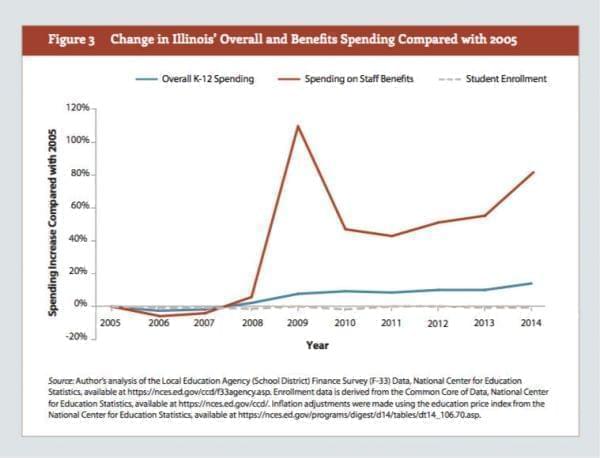

A national study released this week comparing general school funding dollars with the amount spent on staff benefits singled out Illinois — and not in a good way.

The study tracked spending on K-12 education for the years 2005 through 2014. And nationwide, spending increased slightly, around 1.5 percent. But spending on benefits for school staff increased at a much higher rate, which means fewer dollars are making it into the classroom.

The report spotlighted Illinois with a graph showing such a big spike in 2009, it resembles a shark swimming across a shallow pool of school funding dollars.

Max Marchitello, the Bellwether analyst who wrote the report, says it’s probably because of Illinois’ $77 billion teacher pension liability.

“There was a huge spike in 2009, because of the recession, and then it plummets the next year. My guess is, it’s because they had to keep paying their obligations as their economy, like the rest of the country, tanked,” Marchitello says. “Illinois has a big problem because their unfunded liability is over $100 billion in the public pension, and I think it’s around $80 billion for teachers. So they’re really in the hole, and each year, the obligation that they have to pay goes up and up and up, they have to contribute more and more.”

Marchitello says the state’s new school funding formula could help.

Nationwide, spending on benefits rose 22 percent between 2009 and 2014. But in Illinois, spending on benefits rose 82 percent.

Teacher pensions are crucial because Illinois is one of only 15 states where teachers don’t get Social Security.