Study: Most Young Adults Lack Financial Literacy, Opportunities

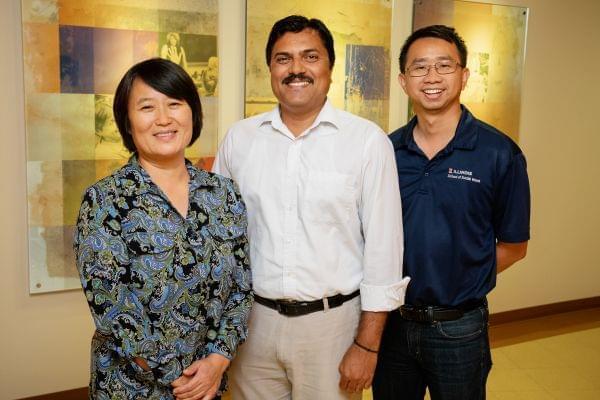

University of Illinois graduate student Gaurav Sinha (center) led a study that found that most surveyed young adults lack financial literacy and money-management opportunities. Social work professors Min Zhan (left) and Kevin Tan (right) co-authored the paper, published recently in the journal Children and Youth Services Review. L. Brian Stauffer / University of Illinois

A new study from the University of Illinois finds that a majority of surveyed young adults lack basic financial skills and access to mainstream financial institutions. The study's author said the findings point to a need for more financial education for young adults.

Roughly two-thirds of the more than 3,000 18 to 24-year-olds sampled for the study were classified as either financially at risk or financially precarious. Thirty-six percent were categorized as financially "at risk," and another 32 percent were classified as financially "precarious." Those who were deemed "at risk" had typically experienced a recent decrease in income, lacked savings and would struggle to come up with $2,000 in case of an emergency. The group categorized as "precarious" had the least financial literacy, and they often relied on alternative financial services — like payday lending — because they lacked access to mainstream institutions, like banks.

Gaurav Sinha, lead author on the study and a graduate student in social work at the U of I, said what differentiates these groups from their more economically stable peers is something called "financial socialization." That term refers to education about basic financial concepts and money-management strategies. Sinha said many young adults learn financial literacy and behaviors from their parents. But he said there are other ways to teach those skills to young people who may not have gleaned them from their parents.

“There are opportunities in schools and colleges and workplaces where you can offer those services and that’s what we are advocating for," Sinha said. He added that it's important to offer training that's tailored to the needs of these groups; a one size fits all approach won't work for everyone.

Additionally, he said, it's not just financial literacy that's lacking, it's also access to lower cost money management services. He cited "bank deserts" — areas of the country where people lack access to banks — as an example.

"If I don't get an opportunity to bank, do you think I can develop those skills?" Sinha said.

The big takeaway from this study, he said, is for employers and schools to identify those who are financially at risk and precarious and then provide services to fit their needs.

Data for this study was taken from the 2015 results of the National Financial Capability Study. The paper will be published in the journal Children and Youth Services Review.

Follow Lee Gaines on Twitter: @LeeVGaines.