What the child tax credit meant for Illinois families

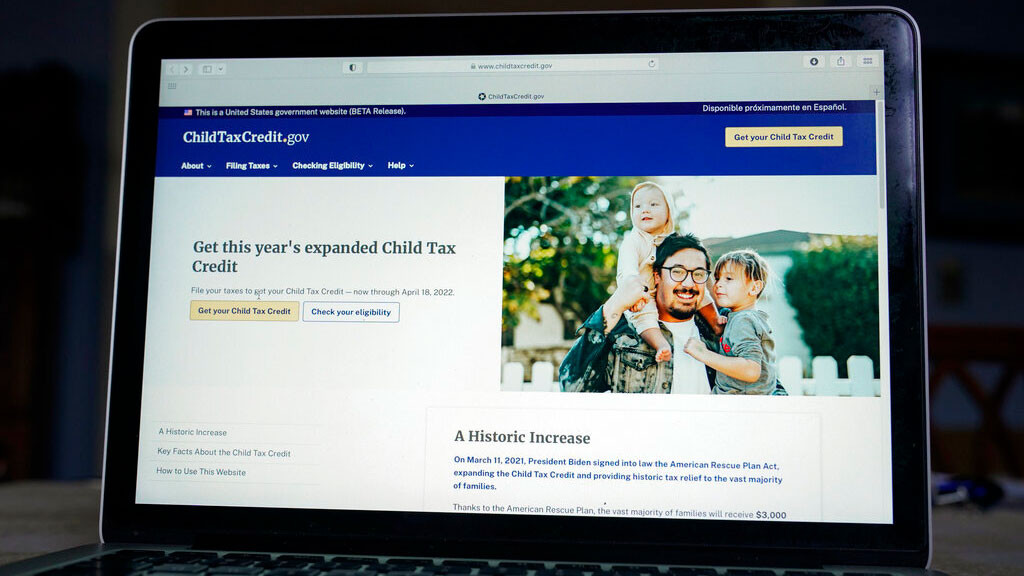

The government website childtaxcredit.gov is photographed on a computer screen Monday, Jan. 24, 2022, in Annapolis, Md. The IRS has launched a revamped Child Tax Credit website meant to steer people to free filing options for claiming the credit. The website includes a new tool that will help filers determine their eligibility and how to get the credit. AP Photo/Susan Walsh

You may be in the process of filing your taxes now, and if you’re a parent, one of the changes to your return this year relates to the Child Tax Credit. In 2021, that credit was expanded. Families were receiving direct cash payments monthly, $300 per child under the age of six and $250 per child under 17 for about six months, but those payments stopped in January because Congress allowed the expanded child tax credit to expire. While parents can still get the remainder of that credit when they file their taxes, many middle and lower-income families are feeling a financial squeeze without the extra cash flow that came monthly.

Researchers and early childhood education advocates in Illinois joined The 21st to talk about what the credit meant for families.

GUESTS:

Cassie Davis

Manager for Data and Research | Voices for Illinois Children, Illinois KIDS Count Report

Ireta Gasner

Vice President, Illinois Policy, Start Early

Dylan Bellisle

Project for Middle Class Renewal, University of Illinois Urbana-Champaign

Lettie Hicks

Parent leader and activist with Community Organizing and Family Issues/POWER-PAC IL | Member, Stepping Out of Poverty Campaign

Prepared for web by Owen Henderson

Help shape our coverage on The 21st by joining our texting group and answering weekly questions. To join, text “TALK” to 217-803-0730 or sign up with your phone number below: