Private Schools Attract $36 Million Via Tax Credit Program

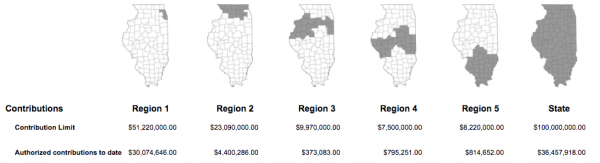

Illinois Department of Revenue"s website shows available tax credits for private school scholarship donations in geographic region of the state. Illinois Dept. of Revenue

Beginning this week, people and corporations donating up to $1.3 million for private school scholarships can get a 75 percent credit toward their state income tax. This was a controversial but bipartisan concept, adopted last summer to help forge a compromise in a big overhaul of Illinois' school funding plan. Such programs have taken off in other states, but it’s off to a slower start here.

On Tuesday morning, when the tax credits became available, donors pledged almost a million dollars per minute — for about half an hour. Then, over the next 24 hours, just another $6 million. That's slow compared to other states, like Georgia, where such tax credits typically get snapped up within minutes.

Rabbi Shlomo Sokora, one of the chief advocates for the plan, says that's because Illinois' program is still new, and its process is cumbersome.

"When these programs are launched in any state, it takes time for people to get used to it and for it to gain popularity. So for example, even in Georgia, where it's a dollar-for-dollar credit, it's a 100 percent credit, for the first few years, it took months until they hit their $50 million cap," Sokora says. "It's a new concept, so people have to get used to the concept, and they have to know how to do it. Once they do it in year one, it's very easy to do it in year two. But this process over here does take time for people to get used to."

Dan McConchie, a Republican state senator from Lake Zurich, proposed the concept, dubbed Invest In Kids. He says donations are bogged down by the state's convoluted process, which involves registering with MyTaxIllinois. That registration, alone, can take up to 10 business days. Once approved, it can be difficult to find how to reserve credits.

"And as a result of that red tape, some of that just takes time, and we know that there are other donors that are in the pipeline that are interested in giving that have just not been able to complete all the red tape that is established so far," McConchie says.

Illinois has capped its program at $100 million. There are similar incentives in 18 other states, though most offer a higher percentage credit and have a more limited cap.

Donations have to flow through one of the seven state-sanctioned Scholarship Granting Organizations. The largest of those, Empower Illinois, issued a press release saying it received money from 960 donors, with the average donation amounting to $4,000. Soroka said he knew of middle- and low-income families who won't realize any tax credit but donated small sums just to support the effort.

Families interested in applying for the scholarships can contact the organization in charge of their geographical region.

As of Wednesday, just over $36 million of the available $100 million in credits had been spoken for. Gov. Bruce Rauner issued a statement touting the program as a success.

“When we unleash the power of private-sector investment incentives like Invest in Kids, great things are possible,” the statement said. “Within its first hour of going live, more than one-third of all Invest in Kids contributions have been allocated for the 2018 tax year. This outpouring of generosity is truly a testament to the many Illinoisans who believe in offering students and their families a choice in their education.”

Teachers unions and other public school advocates opposed the tax credit plan, saying it diverts tax dollars that could be used for public schools to instead benefit private schools.