Rauner Announces Compromise On School Tax-Credit Program

Gov. Bruce Rauner has announced a compromise on a school-funding issue which has held up implementation of a historic funding overhaul.

Gov. Bruce Rauner has announced a compromise on a school-funding issue which has held up implementation of a historic funding overhaul.

Private school scholarships for low-income students will be allocated on a first come, first serve basis, and the application process is set to open at the end of this month. At least one private school official says he wishes that launch date were delayed to give schools more time to educate staff and the parent community about the process.

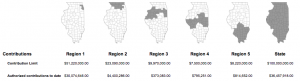

Beginning this week, people and corporations donating up to $1.3 million for private school scholarships can get a 75 percent credit toward their state income tax. This was a controversial but bipartisan concept, adopted last summer to help forge a compromise in a big overhaul of Illinois' school funding plan. Such programs have taken off in other states, but it’s off to a slower start here.

Illinois is preparing to launch a pilot program to test out tax credits for donors to private school scholarships. The five-year $75 million program served as a bargaining chip drawing Republican support to the education funding reform bill that Governor Bruce Rauner signed last month. But less has been said about how it will actually work.

Campbell Hall

300 N. Goodwin

Urbana, IL 61801

217-333-7300