Teamster Retirees Face Big Pension Cuts

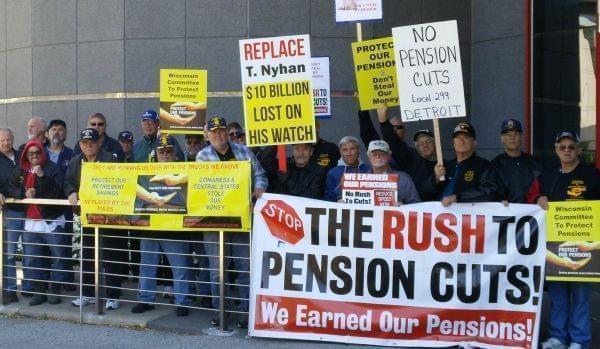

Opponents of the pension rescue plan demonstrate outside a meeting of pension fund officials. Teamsters For A Democratic Union

Thousands of retirees in the midwest, including east central Illinois, face a big cut in their incomes next year. The pension fund for retired members of the Teamsters Union has proposed benefit cuts of up to 60 per cent, saying without them, the fund will run of money in ten years.

The Central States Pension Fund is based in Chicago and has more than 400,000 members - retired and still working. And the problem is very simple according to executive director Tom Nyhan: in 1980 there were four working contributors for every one retiree, while now there is just one contributor for every five retirees.

"The problem is this nagging operating deficit, where you're paying out $2 billion or more a year than you're taking in, in contributions," said Nyhan. "Your investment returns have to be extraordinary in order to be able to offset that that annual operating deficit."

Like other pension funds, Nyhan says Central States was it hard by the recession in 2007 and 2008, but has since tried very hard to recover.

"For example, between 2009 and 2014, I believe we earned more than $10 billion in investment returns over that period of time. and our net assets went down between from $19 billion to $17 billion," said Nyhan. "Because every year, you're writing checks that you don't have the income to cover."

And making the situation even worse is consolidation in the trucking business since de-regulation in the late 1970's and early '80's. Thousands of companies have disappeared, and no longer contribute to the fund, shifting the burden of paying benefits to Central States.

"When you cut someone that's already been retired, and he or she loses 50% of their earned pension, that makes it extremely difficult for them just to be able to maintain their house or maintain being able to put food on the table, for crying out loud," says Howard Spoon, president of Teamsters Local 371 in Rock Island.

Spoon blames the Central States Pension Fund, saying its mismanagement, including poor investment decisions, has failed the retirees.

"But the problem that we're looking at is the ability to attract new companies that we may organize into those funds," said Spoon. "And there's no rescue plan that I see to allow them to be able to participate without having a tremendous unfunded liability strapped down on them."

Steve Scranton, now living in Taylor Ridge, drove for several companies for 37 years and retired three years ago when he was 57. At that time he thought he had a pension "for life."

The Central States Pension Fund says his pension will be cut 43%, but Scranton knows of others facing cuts of 50% to 60%.

"I pay for my own health insurance for my wife and I, said Scranton. "And with my pension, I have been able to do that. It has been doable, until they take away approximately half of what you have earned."

Scranton is s working part-time teaching potential truck drivers at Scott Community College in Davenport, Iowa. But it's part-time, with no benefits. If the cuts go through, he'll have to get a full-time job.

"They need drivers in the industry, so I do not have any fear of not being able to get a job," said Scranton. "But starting over again, and living out of a sleeper berth over the road is something I thought I had put to bed at one time. It will come down to wages and benefits and how wearing that is on a man that's not 21 years oild anymore."

Nyhan the pension fund director, Spoon the Teamsters local president and Scranton the Teamsters retiree all hope for help from Congress and the federal government, but don't think it's all that likely. Again, Tom Nyhan, executive director of the fund.

"If we don't do something, the benefits go to zero, and it's our view that taking less now, but having the annuity for the balance of your life is a better option than just going to zero in 2026," said Nyhan.

The Central States Pension Fund plan to avoid insolvency must be approved by the US Treasury Department, and then will be put to a vote of the members. And it could take effect next summer.