Dems Put Graduated Income Tax Before Voters

Gov. J.B. Pritzker, left, hugs state Rep. Robert Martwick after passage of a constitutional amendment to allow for a graduated income tax in Illinois. Pritzker made the graduated tax a campaign priority; Martwick has spent years trying to get it passed. Brian Mackey/NPR Illinois

Illinois voters will get to decide the future of the state’s income tax. Democrats on Monday approved a measure to put a graduated income tax on the ballot next fall.

Flexing their supermajority, Democrats voted for a measure that would eliminate the Illinois Constitution's requirement that the income tax be flat — where everyone pays the same rate. The move paves the way for higher tax rates on the wealthy.

At the end of more than three hours of debate, Democratic state Rep. Robert Martwick, from Chicago, said this change is what Illinois needs to begin digging out of its deep financial hole.

“This is an opportunity to fix the problems of Illinois, and begin reestablishing the services government is supposed to deliver,” Martwick said.

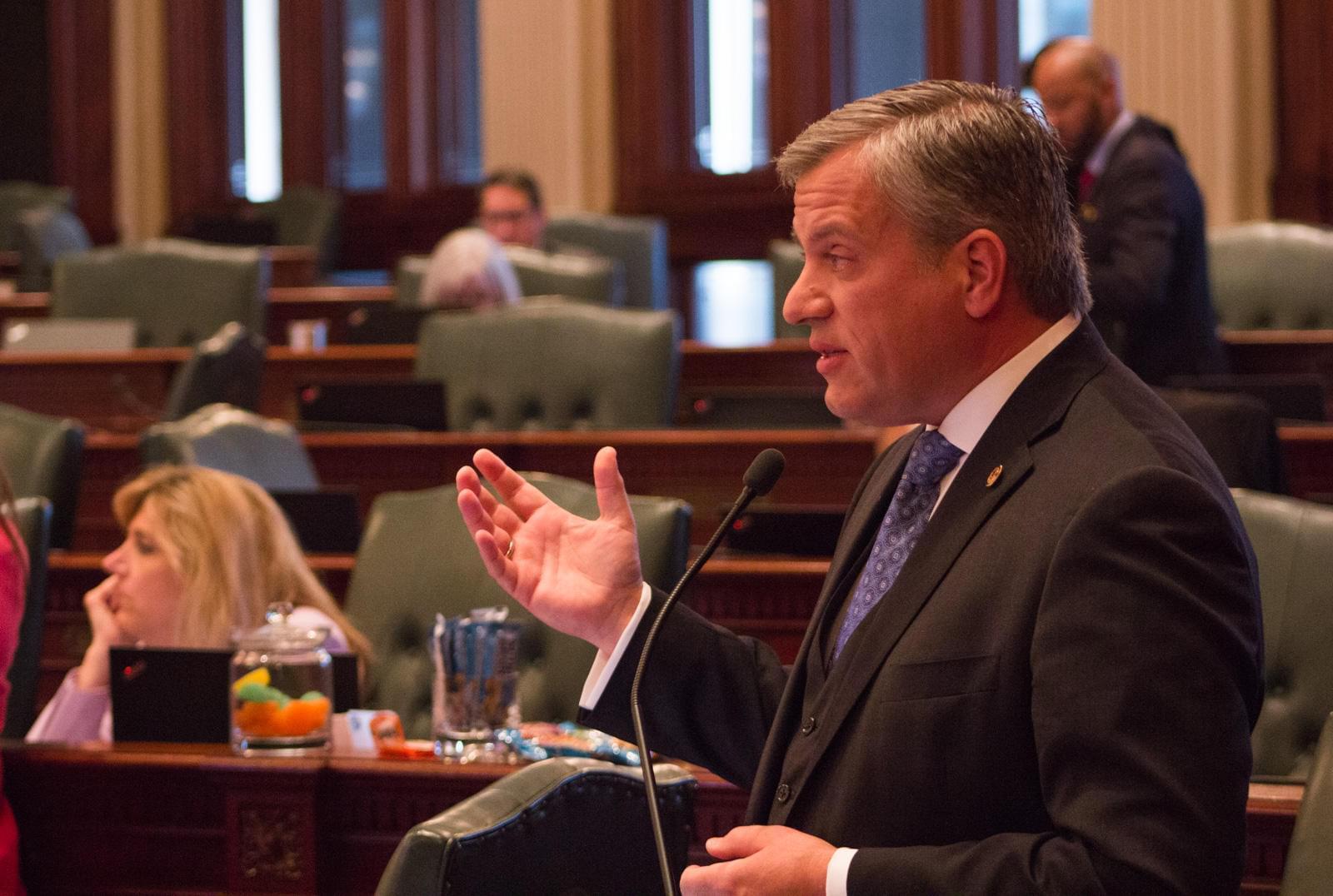

Rep. Robert Martwick, a Democrat from Chicago, has spent years trying to change Illinois' income tax from a flat rate to one that's graduated.

Much of the Republican opposition focused on concerns that Democrats will not stick to their promise that the only people who would pay higher taxes are those who make more than $250,000 a year.

But Republicans — like state Representative Avery Bourne, from Raymond — predict Democrats will soon abandon that limit.

State Rep. Mark Batinick, from Plainfield, was the first of dozens of Republicans who spoke -- and voted -- against the graduated income tax constitutional amendment.

“There simply aren’t enough rich people in this state to pay for the insatiable appetite of spending that we see here in Springfield,” Bourne said.

Ending Illinois’ flat tax has been a top priority for Gov. J.B. Pritzker, who campaigned on the issue.

Monday’s vote sets up a referendum in 2020. Voters at the fall election will get to decide whether to ratify the constitutional amendment.

The rates Democrats have been touting — and that Republicans are calling illusory — remain theoretical.

Legislation to set them in law (Senate Bill 687) passed out of committee late last week. But sponsoring Rep. Mike Zalewski, a Democrat from Riverside, said the language is being amended. He said he still expects a vote later this week.

The constitutional amendment is formally known as Senate Joint Resolution Constitutional Amendment 1.