‘Obamacare’ Rates For 2018 Are Going Up—But Less Than In 2017

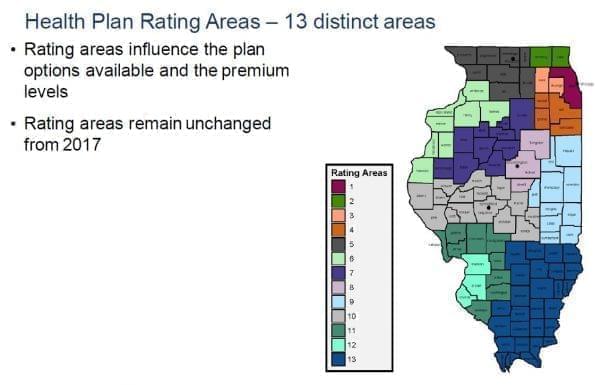

This map shows the 13 Rating areas within Illinois. These areas determine rates and options available on health insurance plans. Illinois Department of Insurance

Illinois residents shopping for health insurance through the Affordable Care Act marketplace for next year could see rate increases as high as 40 percent, under rate plans submitted through the Illinois Department of Insurance.

Illinois premium increases are, on average, lower in 2018 than 2017 for all levels, the department said in a news release.

Illinois is divided into 13 rating areas, which influence available options and plan premiums. That map is unchanged from last year.

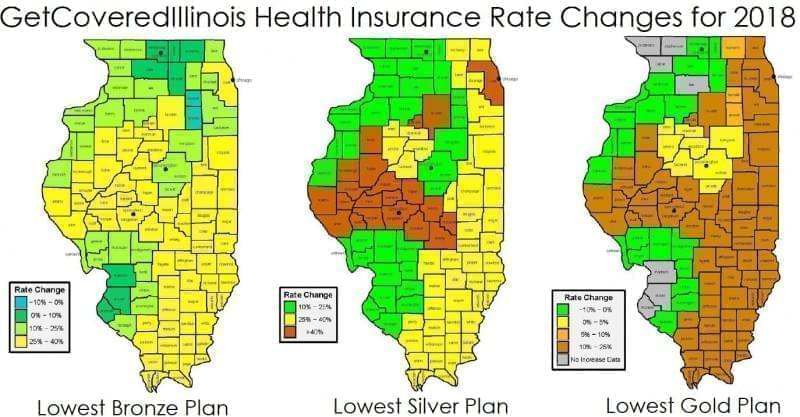

Statewide, rate increases range from 3 to 29 percent for the lowest Bronze plans. The average increase is 20 percent.

The increases for the lowest Silver plans range from 16 to 39 percent and average 35 percent. The second-lowest Silver plans showed an average increase of 37 percent.

The changes for the lowest Gold plans range from a 6 percent decrease to a 21 percent increase, with an average change of 16 percent.

These maps show the rate changes from 2017 to 2018 for each plan type in each Illinois county. The difference is between what the lowest-cost plan cost for 2017 and the lowest projected rate for 2018, regardless of provider.

“There is no question that major structural flaws in the ACA have forced higher insurance rates and separated families from trusted physicians and hospitals,” said DOI Director Jennifer Hammer.

The Open Enrollment Period this year begins November 1, with only six weeks available to sign up at the GetCoveredIllinois website.

DOI reviewed the rates but cannot reject or change proposed rates as long as they are actuarially sound, according to a news release.

Rate plans for the 2018 individual marketplace were submitted by Celtic Insurance Co.; CIGNA HealthCare of Illinois, Inc.; Health Alliance Medical Plans, Inc. (HAMP); and Health Care Service Corporation, a Mutual Legal Reserve Company (HCSC), also known as Blue Cross Blue Shield.

Blue Cross Blue Shield is the only insurer offering individual marketplace plans statewide. HAMP is the only provider offering plans on the small-group marketplace. Humana Health Plans has dropped out of the exchange.

Most of the state can consider plans from two different providers. Residents of Cook, DuPage and Kankakee counties can choose among three providers. Only Blue Cross Blue Shield is available in ten northern Illinois counties and three counties around St. Louis.

DOI submits the rate proposals to Centers for Medicare and Medicaid Services (CMS), which will finalize them next month.

Links

- Kentucky Bet On Medicaid Expansion Under Obamacare. Now It Has A Lot To Lose

- Report: Obamacare Repeal Would Disproportionately Affect Rural Areas

- Obamacare Repeal Could Reverse Progress On HIV/AIDS Treatment And Prevention

- Healthcare Consumer Group Director Defends Obamacare, Challenges Rep. Davis To Debate

- ACA Event To Show Stories Behind Numbers

- Illinois Issues: How Republican Efforts To Toss Out Obamacare Might Affect This State

- A Public Conversation About Obamacare; Illinois Politics; The 21st Expands To Northern Illinois

- Illinois Asks Congress To Avoid Hasty ‘Obamacare’ Action

- We Asked People What They Know About Obamacare. See If You Know The Answers.