Rauner Defends Business Tax Breaks While Slashing Social Services

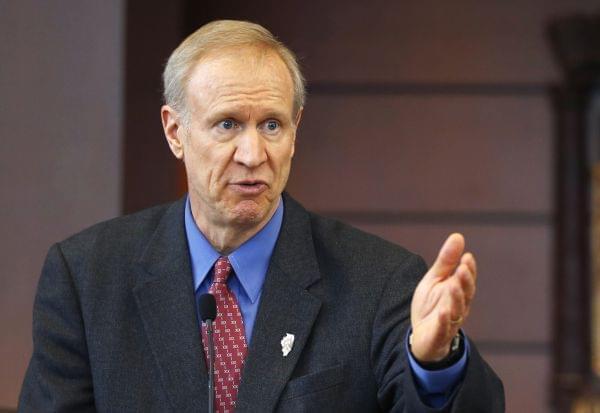

Illinois Gov. Bruce Rauner speaks at a news conference in Chicago. A bipartisan agreement to plug a $1.6 billion budget hole including more than $1.3 billion in fund transfers from a variety of sources to avert shutdowns of Illinois state programs and services was signed into law by Gov. Rauner on Thursday, March 26, 2015 (AP Photo/Charles Rex Arbogast, File)

Gov. Bruce Rauner says he choose to award business tax credits to uphold Illinois' trustworthiness with companies, but the Republican's critics are calling it "beyond the pale."

Social service organizations are still reeling from the unexpected news they received a week ago that Gov. Rauner was immediately cutting off their state grants.

No longer would there be money to bury the indigent.

Funding for The Autism Program, eliminated. Funding stripped from addiction prevention. Cuts totaling $200 million.

At the same time, Crain's Chicago Business now reports, that Rauner was going forward with $100 million in business tax incentives. Rauner told Springfield's State Journal Register this was his reasoning: "Well see, those EDGE credits were negotiated under the Quinn administration Some businesses had some understandings of timing and circumstances, and we had a risk of credibility as a state government and an issue of credibility with the business community on some of these issues. So we're dealing with them."

Of course, social service agencies say they also had been promised the money.

The Illinois Federation of Teachers union says giving corporations tax breaks while slashing services shows Rauner's priorities.

The Rauner administration says the grant cuts are necessary to bring state spending in line, and says lawmakers had been previously warned - including at a legislative hearing - that those cuts could be coming.

Rauner told the SJR that he's working to revamp the state Dept. of Commerce and Economic Opportunity, and its new leader, businessman Jim Schultz, is developing criteria to measure tax credits' effectiveness.

"I'd like them yesterday," Rauner said.