What To Expect For Obamacare Enrollment In 2017

A number of flyers related to health care enrollment are on the walls at Champaign County Health Consumers in Champaign. Jeff Bossert/Illinois Public Media

Sign up started last week for coverage under Obamacare in 2017. Like much of the country, people across Illinois are seeing fewer choices and higher monthly premiums. But one group that’s helping people sign up for coverage says, at least so far, they don’t expect customers to have to scramble to find affordable coverage.

Kevin McGuire of Urbana is getting used to his appointments with Champaign County Health Care Consumers. He jokes around a bit when Client Services Coordinator Adani Sanchez when logging in to the Health Care.gov website, frequently forgetting his password.

“I think the last time I got in, they had to send me another reminder,” he said.

Sanchez had to call the marketplace to solve the password issue, but McGuire eventually was able to get it reset.

He knew going into enrollment for 2017 that his premiums would go up.

“I heard people saying that it was going to go up, and everything goes up except for how much we get paid,” he said. “But - I guess I expected that.”

McGuire works as a stagehand in central Illinois – something he’s done since the mid-80’s and the first Farm Aid concert at the University of Illinois. Work expects to pick up with renovations complete at the State Farm Center, and shows elsewhere during the holiday season.

But McGuire doesn’t work enough regular hours to qualify for health care.

Kevin McGuire (L) helps co-workers set up for a performance at Champaign's Virginia Theatre

“So I was covered on my wife’s insurance, and then when we divorced in 2005, then I didn’t have anything,” he said. “And I was unable to afford anything. And just decided I wouldn’t get sick, or hurt, or need health care.”

Right now, McGuire pays about $375 a month for his mid-range, or silver, plan with Health Alliance, but that’s before a tax credit of about $90 a month based on earnings. Next year, his monthly cost will jump.

That’s because rates for some of the most popular silver plans in central Illinois increased 35-to-40 percent for 2017. Shoppers also have two fewer companies to choose from. Both trends are similar to what people across the country are seeing on the health insurance exchanges.

One reason why – a greater number of sicker people on the rolls.

“The extreme worry is basically that as you keep increasing these prices, you actually make it harder and harder for healthy people to sign up, because you don’t want to pay the prices,” said Julian Reif, who researches the economics of health insurance at the University of Illinois.

But Reif says many healthy people don’t mind paying the roughly $700 for violating that mandate.

“And so while people were thinking that healthy people would basically have to sign up because they have to comply with this mandate – or maybe they’re attracted by the subsidies,” he said. Either the penalty is not large enough, or perhaps the subsidies are too small. For whatever reason, a lot of healthy people are deciding not to sign up for these plans.”

But the rate increases don’t tell the full story.

Adani Sanchez says her clients at Champaign County Health Care Consumers understand that costs tend to go up, but so do the tax credits, or subsidies, which are also adjusted every year.

“There’s a lot of sticker shock too- when people get the notices from their companies because their companies also aren’t taking into account new subsidies,” she said.

One difference in central Illinois -- the companies pulling out of the marketplace for 2017 -- like United Health Care and Aetna – either never offered coverage here, or priced themselves out of the market early on.

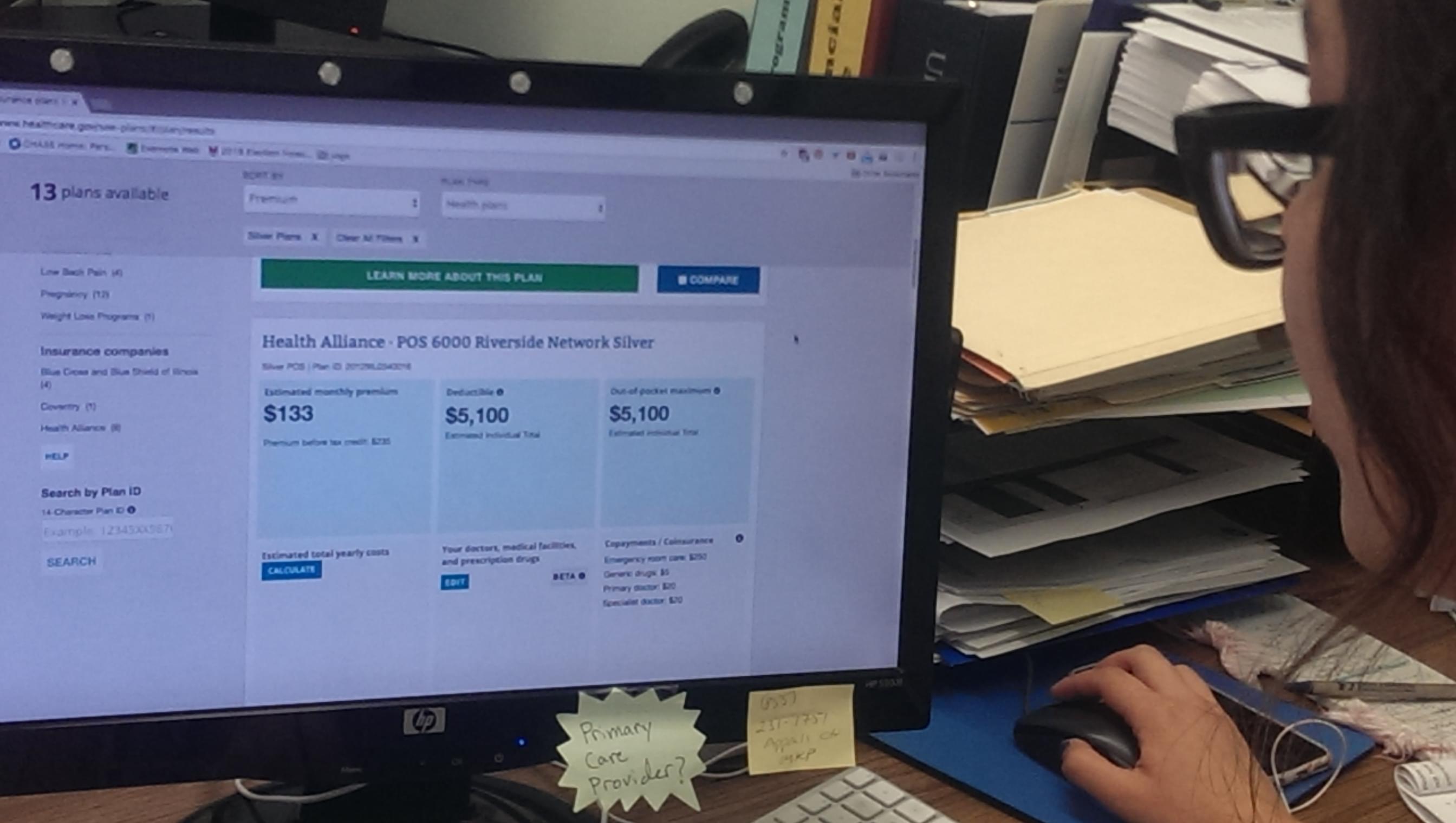

Adani Sanchez at Champaign County Health Care Consumers works with the Health Care.gov website at her office in Champaign.

Sanchez says roughly 10-percent of clients changed their plans months ago in order to avoid paying higher rates the next year. So they’re not affected by the reduced options.

And she says only one client was enrolled with the now-defunct Land of Lincoln.

“I think we ended up being a little more concerned than we needed to be, because as we were looking through our clients, and trying to figure out ‘oh, I think this person had it, this person had it, we were finding – oh, like my one client,” she said. “I had switched them last year. They had found something else at a better price point. No one was left out in the cold.”

That’s because the two remaining providers in the Champaign-Urbana area – Blue Cross-Blue Shield and Health Alliance – offer some two dozen plans between them.

For their part, an executive with Health Alliance says determining rates on the health care exchange requires constant evaluation.

Sinead Rice Madigan is the company’s Vice President for Government Business.

“You’re not just looking at the risk of the member, you’re looking at the benefit designs that you’re able to provide in the marketplace, you’re looking at your networks that you’re able to set up to provide that coverage as well,” she said. “Certainly it’s also difficult from the way the regulations are set up that you have to think about pricing for next year – in February and March of the year you’re in.”

Health Alliance has dropped from 22 to 17 plans on the exchange, and the company is just starting to send out letters to current enrollees. It’s still early in the process, but Madigan says so far they aren’t getting many calls from customers, concerned about 2017 rates.

And most people do get some sort of tax credit. Federal data shows some 75-percent of Illinois residents who buy insurance on the exchange get a subsidy.

That includes Kevin McGuire. The $300 a month he pays now will go up to $530 next year, but his monthly subsidy also increases.

Urbana-based Health Alliance is working with clients as the enrollment period starts up for Obamacare in 2017.

Like many people, he switched to a slightly lower silver plan for 2017, so in the end he’ll pay about $50 more a month after the tax credit. With some two dozen plans available through the remaining two providers – Blue Cross Blue Shield and Health Alliance - staff at Champaign County Health Care Consumers say they expect most people in this part of the state will be able to find good, affordable coverage.

McGuire says for him -- so far, so good on his Health Alliance plan. He was recently treated for severe arthritis, deciding he needed a doctor as opposed to simply "waiting it out."

He says getting enrolled for health care, and finding a physician at Carle has filled a laundry list of needs.

“Probably for the first time in my adult life, I had a doctor who really spent time with me, cared, seemed to be concerned, listened, and also had some great ideas,” he said.

Clients like Kevin say the enrollment process can be daunting, and recommend finding a group like Champaign County Health Care Consumers to walk through the registration process.

There’s a lot of speculation about the future of the Affordable Care Act, now that Donald Trump has been elected president. But in the meantime, an open enrollment period for medical care is underway.

That started November 1 and runs through the end of January. For coverage that starts January first, customers must sign up by December 15th.

Links

- Illinois Rates Under Obamacare To Jump 40-50%

- Higher Costs, Fewer Options Expected For Obamacare; Concerns Over Bats In Illinois

- Open Enrollment Period For Health Care Ends Sunday

- Glitches Return To HealthCare.Gov As Enrollment Clock Expires

- Health Care Enrollment Exceeds 6 Million

- Health Care Enrollments Up, But Still Well Short Of Goal

- Enrollment Through Federal Health Market Surges In December

- Enrollments For The Health Care Exchanges Trickle In, Slowly

- Health Alliance: Enrollment Criteria Prompted Being Dropped

- Health Alliance Loses Retiree Contract

- Supreme Court Rules Obamacare Subsidies Are Legal

- Health Care Law Could Cut Down On Incarceration Rates

- Health Care Law Means Champaign County To Have Largest Medicaid Growth

- Health Care Law Turns Three, Public Still Confused

- The Kaiser Family Foundation's Subsidy Calculator for health care law