Illinois House Passes Budget, Tax Increase, But Rauner Promises Tax-Hike Veto

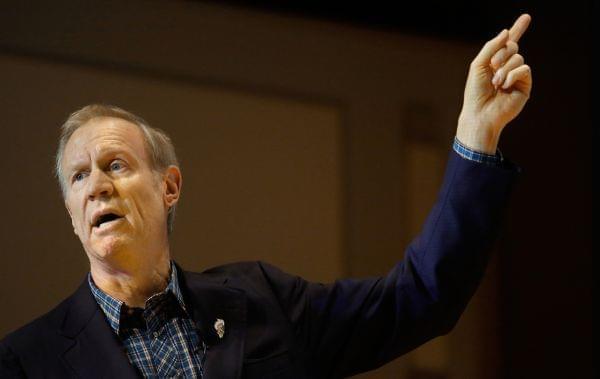

The Illinois House passed both a budget and an income-tax increase Sunday, but Gov. Bruce Rauner has promised to veto the latter. (AP Photo/Seth Perlman)

The Illinois House of Representatives on Sunday passed both a $36.5 billion budget and an income-tax increase to pay for it, but both still must clear the state Senate. And the tax increase was met with an immediate promise of a veto from Republican Gov. Bruce Rauner.

House members would need 71 votes to overcome that veto. The tax increase, which would raise about $5 billion and raise the tax rate from 3.75% to 4.95%, passed by a 72-45 vote, with some Republicans breaking from the governor to back the bill.

The votes happened as Illinois enters its third straight year without a budget and faced the threat of bond-ratings agencies lowering the state’s credit rating to junk status. That would make borrowing costs higher for major projects and provide an embarrassing black eye to Illinois. Construction also stopped Friday on a number of major state construction projects.

"I will veto (Democratic House Speaker) Mike Madigan’s permanent 32 percent tax hike," Rauner said in a printed statement shortly after the votes. "Illinois families don’t deserve to have more of the hard-earned money taken from them when the legislature has done little to restore confidence in government or grow jobs.”

For his part, Madigan thanked those who votes for the measures for making difficult decisions.

House Speaker Michael Madigan thanked those who supported the budget bill and income-tax increase.

“I’m grateful legislators worked together to provide for our schools, protect medical care for the frail elderly, services for survivors of domestic abuse and others in great need,” Madigan said in his own statement.

The budget passed after fairly brief debate on an 81-34 vote.

But tensions were high before the tax vote, and not along strictly partisan lines.

Before Rep. Jeanne Ives, a Wheaton Republican, spoke, she was booed by Democrats, who were themselves admonished for their behavior by Rep. Lou Lang, the Democrat who is deputy majority leader.

Ives then urged representatives to vote against the tax increase.

“The only people who will benefit from this are the public-sector unions,” she said, later adding, “And yet you haven’t shrunk the size of government at all - at all!”

But fellow Republican Michael Unes of East Peoria said that he would vote for the increase as a way to end the two-plus years without a budget.

“If it costs me my seat, so be it,” Unes said to scattered applause.

Democratic Rep. Carol Ammons of Urbana took aim at Rauner before the vote, criticizing the pro-business “turnaround agenda” he has made the centerpiece of his time in office.

“Anyone voting no today, at the brink of collapse, are voting no because of the turnaround agenda,” Ammons said.

The tax increase would raise the individual income tax rate from the current 3.75 percent to 4.95 percent and raise the corporate tax rate from 5.25 percent to 7 percent, both retroactive to July 1.

After two-plus years of budget impasse, Illinois has $14.7 billion in past-due bills as of June 30.

Ammons was not the only area lawmaker to vote for both bills on Sunday. Rep. Chad Hays, a Catlin Republican, also backed both.

But Republican Brad Halbrook of Shelbyville voted against both measures.